Accountant’s Functions

From the entry level to CFO following are some of the major functions of accountants

- Accounting

- Supply chain & Inventory management

- Expense and income management

- Accounts receivable & Payables

- Fixed Asset Management

- Auditing

- Cost accounting & Project Costing

- Procurement

- Financial Analysis

- Business Intelligence

- Budgeting & Projections

The functions highlighted and many associated functions have been performed by accountants and accounting and audit firms since accounting came into being and with the birth of technology many software solutions have been developed to preform these tasks.

Accounting & Audit firms have been just using these softwares and to an extent helping organizations install these softwares for some additional revenue but major chunk of the revenue stream is earned by the technology firms who have made these softwares , using accountants knowledge.

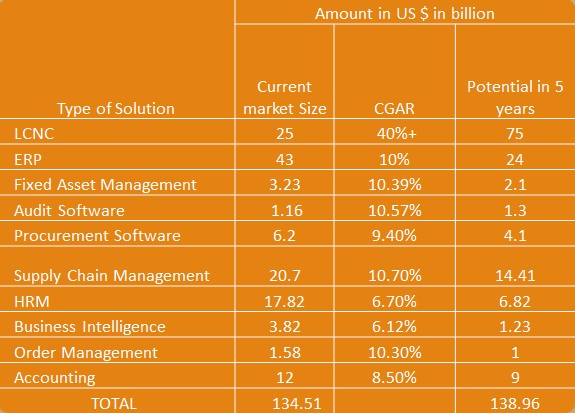

The market size of the global audit and advisory industry is around $ 220 billion ,growing at a CGAR of 4.1 % contrary to the same the softwares used primarily by accountants and auditors are growing at an average rate of 9 % and is currently valued around $ 108.Billion , of which finance professionals have a very insignificant share. , thus its prudent to explore higher growth areas .

A much easier, lucrative and related stream for the Finance professionals is the No-code or Low code (LCNC) platforms . The Current market size of this stream is around $ 25 billion , but its growing at an exceptional pace of 40+%, thus it would very quickly over take the conventional software development solutions .

Market Size & Growth Potential Of Accountant's Softwares

The total software market size is $ 578 bn. Of which around $ 108 bn is the market of softwares used by finance individuals in performing their core functions.

It is quite evident that the market potential is huge and accounting, advisory & auditing firms should invest time and money to make such similar softwares for them selves by technologists as it was done by them as license reseller ship and installation of softwares is just the tip of the technology solutions revenue stream.

Technology solutions and services are taking over the services of finance professionals very fast as AI has started performing difficult calculations very easily.

With the pace of technology a lot of more core functions will be taken over by these technology solutions and thus is imperative to safeguard future revenue potential and venture into these and similar solutions to safeguard future revenue streams

Accounting and advisory firms should venture into software development as per their clients service delivery

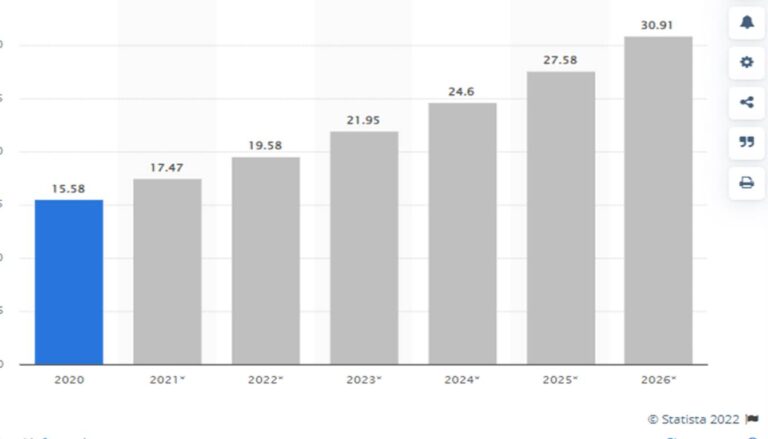

LCNC Platforms

Tools and platforms running on low-code and no-code technology eliminate the need for intensive technical coding and simplify development.

The LCNC platforms often come with visual development tools and a drag and drop interface, thereby streamlining the process and making it easier, faster, and more affordable while reducing the dependency on IT professionals, companies, and agencies in general.

Since Finance Professionals are usually the business process owners and /or developers so these platforms can easily be understood and enable finance professionals to automate such processes without much dependence on IT professionals. This means a very lucrative business offering for finance professionals.

By 2030, the global low-code/no-code development platform market is expected to generate USD 187 billion in revenue. It will account for more than 65% of application development activity by 2024.

North America & APAC regions are the biggest and fastest LCNC markets.

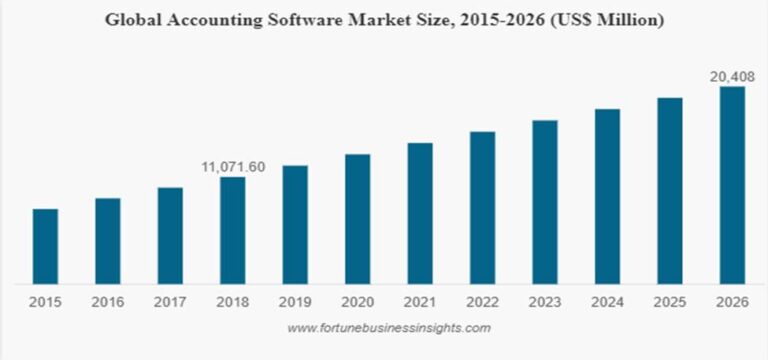

Accounting Softwares

With the evolving business methodologies ,it is imperative that the accounting software also evolve to account for the changing environment.

With the influx of businesses like e-commerce , digital banking and the conventional business model automating the business processes the accounting softwares have also evolved and their importance and relevance has been growing continuously to ensure timely recording of financial transactions

ERP

Potential Areas of Investment

Some Key statistics shown on Oracle NetSuite website regarding ERPs are as follows :

- Revenue growth occurred for ERP in all areas in 2019, with strong growth for administrative ERP with financial management software (FMS) growth at 7% and human capital management (HCM) growth at 10%.

- The ERP market size in North America is worth over $10 billion.

- Asia-Pacific is an emerging ERP market expected to achieve a compound annual growth rate (CAGR) of 9.8% through 2027.

- In a survey of IT decision-makers, 53% said ERP was an investment priority, in addition to CRM. ( Oracle NetSuite )

- Nearlyone-third of companies communicate about ERP implementation before selecting the product, 56% do it during the selection process and 13% share information right before going live.

- The top three benefits businesses said they gained from an ERP system are reduced process time, increased collaboration and a centralized data system.

- An average for ROI time in a group of companies that implemented ERP was just over 2.5 years.

- The top three business goals cited for implementation are achieving cost savings (46%), better performance metrics (46%) and improved efficiencies in business transactions (40%).

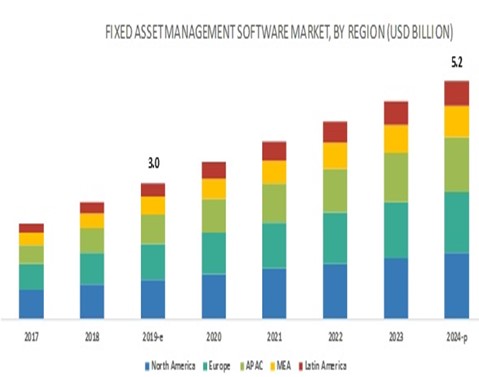

Fixed Asset Management

Potential Areas of Investment

Supplychain & Warehousing

Potential Areas of Investment

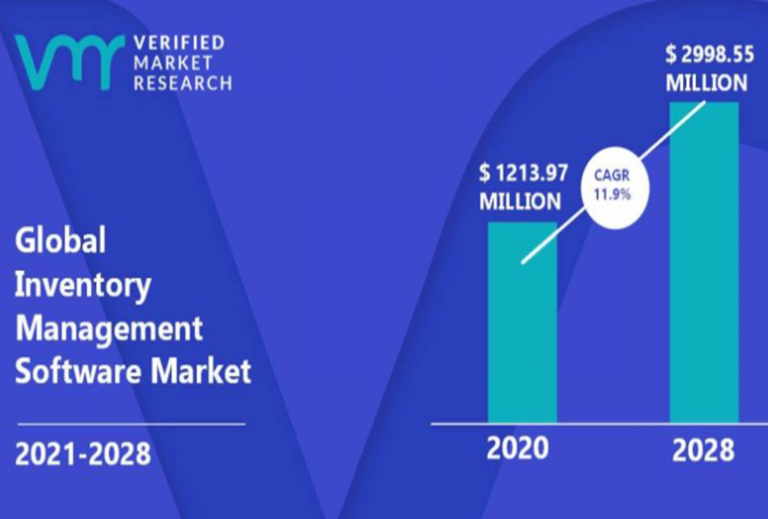

Inventory Management Software

Potential Areas of Investment

ERP Pakistan

- Revenue in the Enterprise Resource Planning Software segment is projected to reach US$40.56m in 2021.

- Revenue is expected to show CAGR 2021-2026 of 8.05%, resulting in a market volume of US$ 59.74m by 2026.

- So in the next 5 years Revenue share of $ 20mn is up for grabs

- The average Spend per Employee in the Enterprise Resource Planning Software segment is projected to reach US$0.52 in 2021.

Suggestions to Accounting & Audit Firms

- Accept change , business methodology which is drastically changing, utilizing technologies for efficiency & controls , this change should be adopted by the accountants also ,as conventionally assignments of audit, book keeping and advisory have also evolved

- Take control over software solutions of your domain. Outsource coding but maintain material ownership in the product, hence material revenue will follow. Make strategic partnerships for technological advancements to remain relevant

- Accounting and Audit firms who will not adopt technological advancements will themselves be faced with qualification of a going concern .

- For optimizing efficiency and growth businesses have adopted technology solutions and thus business processes have largely been automated or will be in the near future & thus accountants should evolve also to offer services for these changes.

- In order to actually tap in the Technology revenue stream a proactive approach is required by engaging potential clients instead of waiting for companies to launch PRs .

- Creation of a technology vertical will prove beneficial for Accounting & Audit firms in tapping to the huge potential revenue stream , huge team of coders is not required , strategic partnerships with technologist , like AMIS will be suffice.